Compliance Day Istanbul 2019

Here you can find a brief summary of our Compliance Day Istanbul 2019 event.

Compliance for Fintech

After the opening speech, the first session started with our speakers: Tarik Tombul, Erdost Pehlivan, Ufuk Sinel and Fatma Atila. They discussed Fintech compliance.

Tarik Tombul explained that the compliance process was introduced by legislators in the 1970s and became well developed in Turkey in the 2000s.

During this part of the event, the participants explained the definition and importance of the compliance department within the company. It was underlined that the duty of the compliance manager is to manage risks, and the task of the compliance department begins before the development of a new product or technology.

It was also stated that working with international data providers such as Dow Jones provides great benefits through know-how.

The speakers also talked about managing relations with regulators.

During the event, participants further emphasized that global and local lists are being used in conjunction with Fineksus solutions.

How will AI transform AML Compliance?

Tuncay Coruh shared his thoughts on “How will AI transform AML Compliance”

What is AI? What is machine learning and how does it work? Tuncay Coruh stated the 7 aspects of the AI problem.

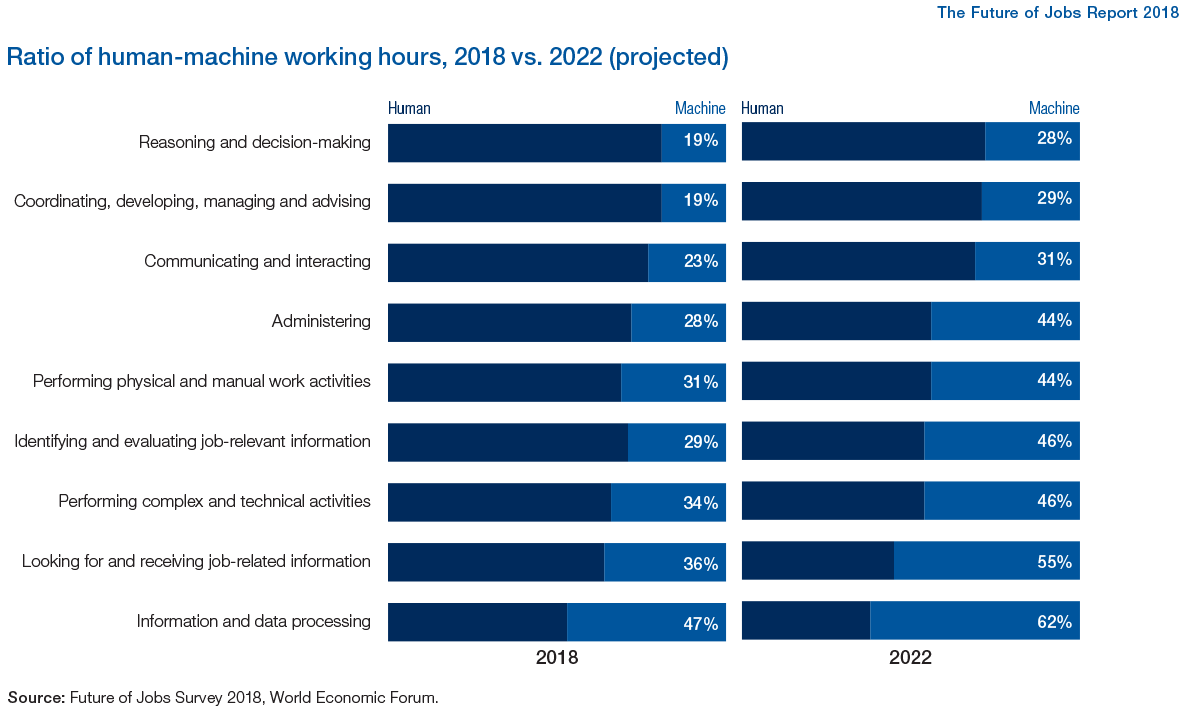

“According to Future of Jobs Survey 2018, machines are expected to perform about 42 percent of all current tasks in the workplace by 2022. Machines will do more tasks than humans,” Coruh said.

He pointed out that AI is used in PayGate Inspector and PayGate Analyser for AML Compliance. According to him, the AI and Machine Learning based model works in the following 4 steps:

- Analyzing Data

- Learning Results

- Calculating Probabilities

- Concluding with User Decision

Through continuous learning, there’s a reduction in false positive rates, and detections in anomalies becomes possible.

Evolving Sanctions & AML compliance: Balancing new challenges and practical response to risk

Christophe Amez spoke about the trends we see in the world of sanctions and regulatory compliance.

He said that not all institutions managed to implement effective sanctions and that it’s the AML program that truly protects the organization. Amez continued by saying, “It is also fair to say it is very dynamic and fast evolving risk environment.”

He explained the “50% Rule”:

- Sanctions requirements are now more comprehensive and complex, adding new needs to a compliance program

- OFAC “50% Rule”: includes cases where 50% or greater ownership by

multiple sanctioned or entities would cause the sanctions to apply

to the owned entity - The rule applies to all OFAC Sanctions Programs

- Practical consequence: greater emphasis on identifying potential full

or partial beneficial ownership - The “50% Rule” means only screening against lists is not enough. Additional risk intelligence is required.

He also explained the AML requirements in Turkey:

While no specific PEP screening has been laid out under Turkey’s AML laws, financial institutions must;

- Pay special attention to complex and unusual large transactions and the ones which have no apparent reasonable legitimate and economic purpose

- Take necessary measures in order to obtain adequate information on the purpose of the requested transaction

- Keep the information, documents and records obtained in this scope for submission upon request of authorities

- Pay special attention to business relationships and transactions with the natural and legal persons, unincorporated organizations, and the citizens located in risky countries

What is the new normal of AML Compliance for banks?

Ahmet Vefik Dincer, Korhan Bilsel, Selim Onal, Serkan Salik, Alpaslan Cakir, Ahmet Burak Erkol discuss the new normal of AML Compliance for banks.

Selim Onal stated that banks worldwide have been fined 340 billion dollars in total and pointed out that working with customers under different regulations emphasizes the importance of KYC.

He also drew attention to the fact that 3.7 billion dollars have been invested into Fintech sector.

Alparslan Cakir, who has been the head of MASAK working group since 2002, stated that every bank should work on their own risk map. He suggested that it would be easier to manage risks if companies were knowledgeable about relevant products, customers, sectors, as well as which products to invest in and which geographic areas to work in.

Serkan Salik expressed that compliance processes are not only legal requirements but they accept them as social responsibilities.

Ahmet Burak Erkol mentioned the hardships of a bank being in a remote geographical location and explained that integration units have been formed that are independent from management in order to ensure coordination.

He also discussed which duties the integration unit has in order to stop black money from entering the financial sector and what effects the digitalization of banking has on integration departments.

Korhan Bilsel mentioned the advantages and disadvantages of being a new bank.

Ahmet Vefik Dincer talked about how Asian banks have more than 90% false positives and stated that this means every transaction made by the banks have to be examined by the compliance units. He said that with the help of AI, these rates can be lowered significantly.

Ozgun Kars, Solution Advisor