Digital Journey of a Customer Onboarding

Why we need such a technology for both ends?

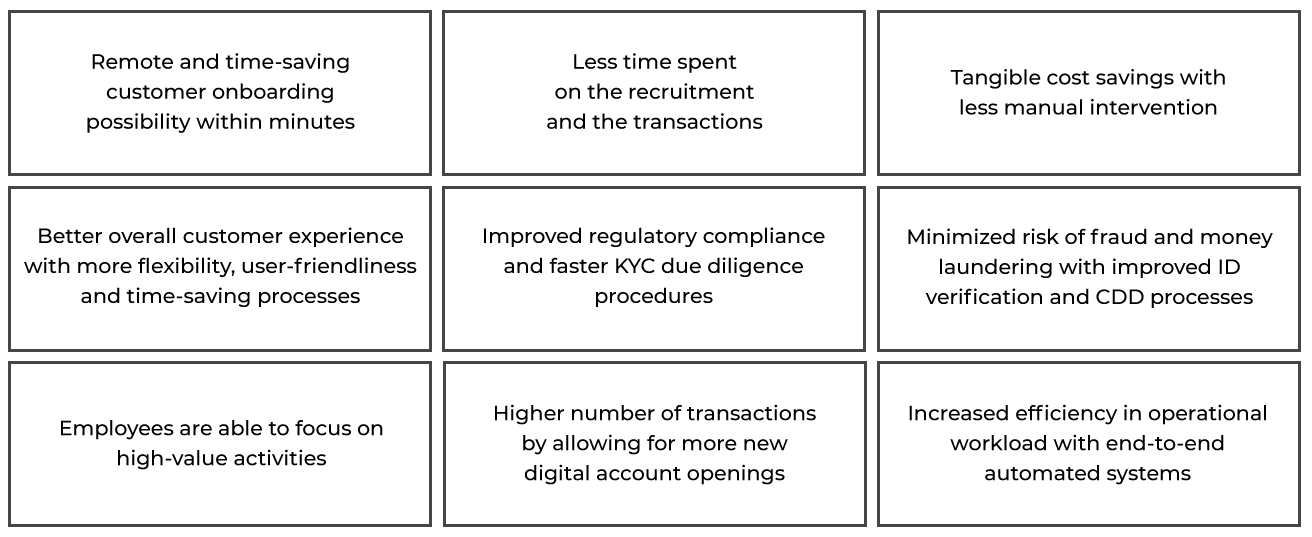

Digital customer onboarding emerges as the solution to the challenges in the financial industry resulting from the digitalization and globalization. Financial institutions struggle with creating a smooth digital experience for their clients while at the same time ensure the same quality, security and guarantee for their services as they did in their in-branch customer operations. Digital or remote onboarding provides advantages both for the banks, fintechs and other financial institutions and the consumers in many ways. As the FIs benefit from advancements in regulatory compliance, cost-effectiveness and time-management, consumers enjoy seamless, faster and more flexible online financial services.

Benefits for banks, Fintechs and other financial institutions

In corporate banking, client acquisition in a physical environment may cost up to $4.000,

whereas with digital onboarding, it can be reduced to $1.200.

Benefits for consumers in a digitalized eco-system

Banks that started to equip their systems with the best working ID verification systems

have increased their customer acquisition by 84%.

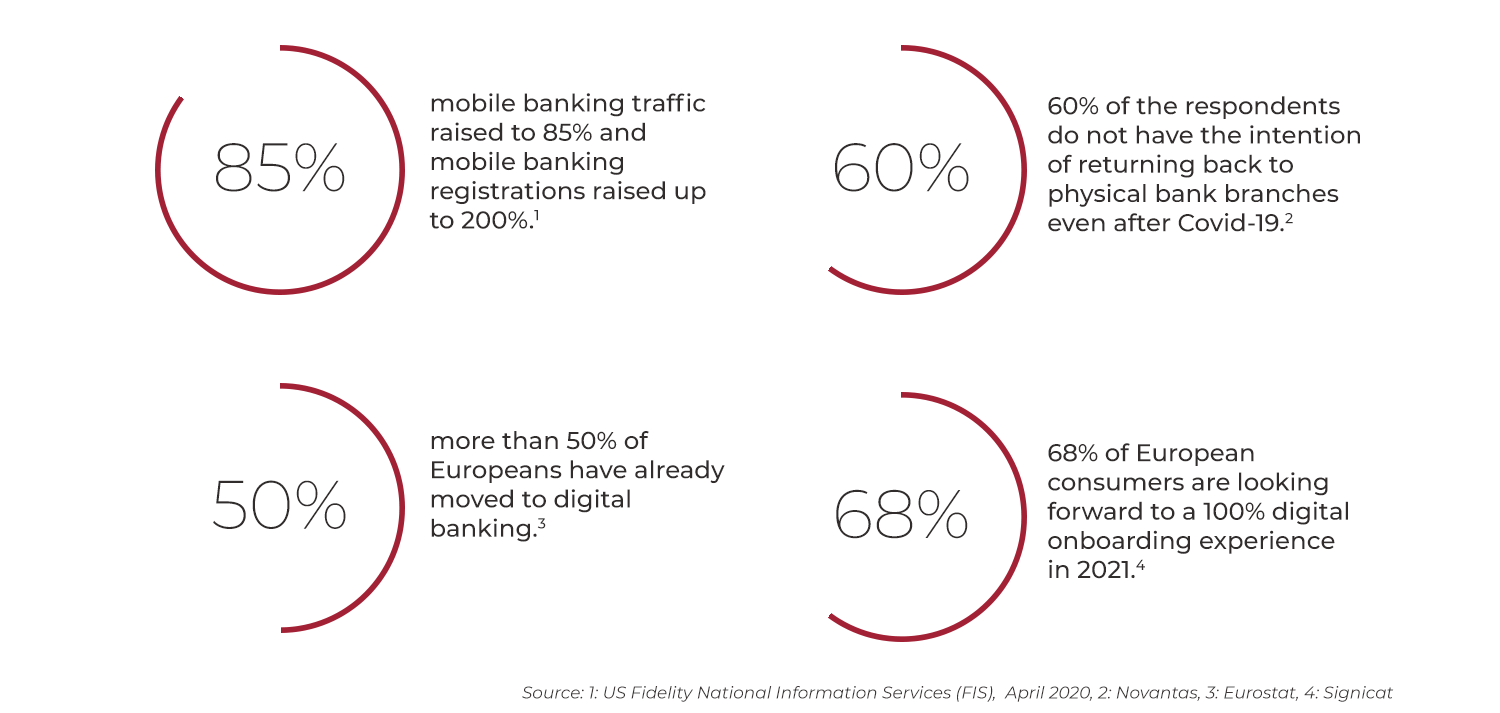

Global facts on digital onboarding

Fact Check

The rate of European consumers who are abandoning digital banking applications has risen in 2020 compared to 2019. Although there is a high potential due to the increase in mobile usage, it is important to develop user-friendly mobile applications and processes. It is expected that European banks will search for efficient FinTech partners as a measure, in order to improve their digital onboarding services and capabilities.

Forecasts on implementation process of the technology in Turkey

References

- Bezemer, Vincent. (August 2020). Digital Onboarding and Origination: The Cure for Banks’ Customer Acquisition Pains. Retrieved from https://bankingjournal.aba.com/2020/08/digital-onboarding-and-origination-the-cure-for-financial-institutions-customer-acquisition-pains/

- Electronic IDentification (March 2021). Digital Onboarding: definition, characteristics and how it works. Retrieved from https://www.electronicid.eu/en/blog/post/digital-onboarding-process-financial-sector/en

- Fintech OS. (March 2020). Digital Onboarding Done Right: The Best Way to Win & Keep Customers. Retrieved from https://fintechos.com/digital-onboarding-done-right/

- iproov. (October 2020). Online Banking in the U.S. Part 1: How 20 of America’s Top Banks Are Balancing Security with Usability for Onboarding. Retrieved from https://www.iproov.com/reports/online-banking-in-the-us-part-one-onboarding

- Keskin, Burak & Canpolat, Yasar. (November 2020). Turkey is to adopt video identification as primary method during digital onboarding. Retrieved from https://www.canpolatlegal.com/2020/11/23/turkey-is-to-adopt-video-identification-as-primary-method-during-digital-onboarding/

- Ongun, C., Piyal, F., Erkan, D. (May 2020). The Financial Technology Law Review: Turkey. Retrieved from https://thelawreviews.co.uk/title/the-fifinancial-technology-law-review/turkey

- Sheng, Ellen. (May 2020). Coronavirus crisis mobile banking surge is a shift that’s likely to stick. Retrieved from https://www.cnbc.com/2020/05/27/coronavirus-crisis-mobile-banking-surge-is-a-shift-likely-to-stick.html

- Tattersall, Michael. (December 2020). Nearly two-thirds of European consumers abandoned digital banking applications in 2020. Retrieved from https://www.businessinsider.com/european-digital-banking-application-abandonment-jumps-in-2020-2020-12