Open Banking Framework in the Age of Digitalization

Open Banking and the API

Open Banking is defined as the secure method for businesses and consumers to exchange data in return for receiving faster payment-related or other innovative banking services by the new or already existing companies. It promises to revolutionize the whole system of managing money. The intention of making the system easier for companies and more useful for the consumers can be actualized by creating a process of safe data sharing. Basically, the banks and the building societies are required to share certain kind of information with the other sanctioned companies; however, this exchange of data is only possible if there is a clear consent of the user and in a standardized, transparent and secure way. To ensure the greatest safety of the use of personal data in Open Banking system, the regulations are highly strict in this area.

Together with the increasing pace of digitalization, the developments in the Open Banking field have evolved simultaneously. Another reason for the growing number of Open Banking platforms is the need to catch up with the regulatory requirements. The role of APIs in this new digital-driven system is to make sure that the banks and the third-party firms collaborate with each other for the sake of innovation as a new connectivity channel.

In the competitive Open Banking landscape, making use of the possibilities and opportunities presented by an open API system has become a prerequisite for the success.

2020 Open Banking trends

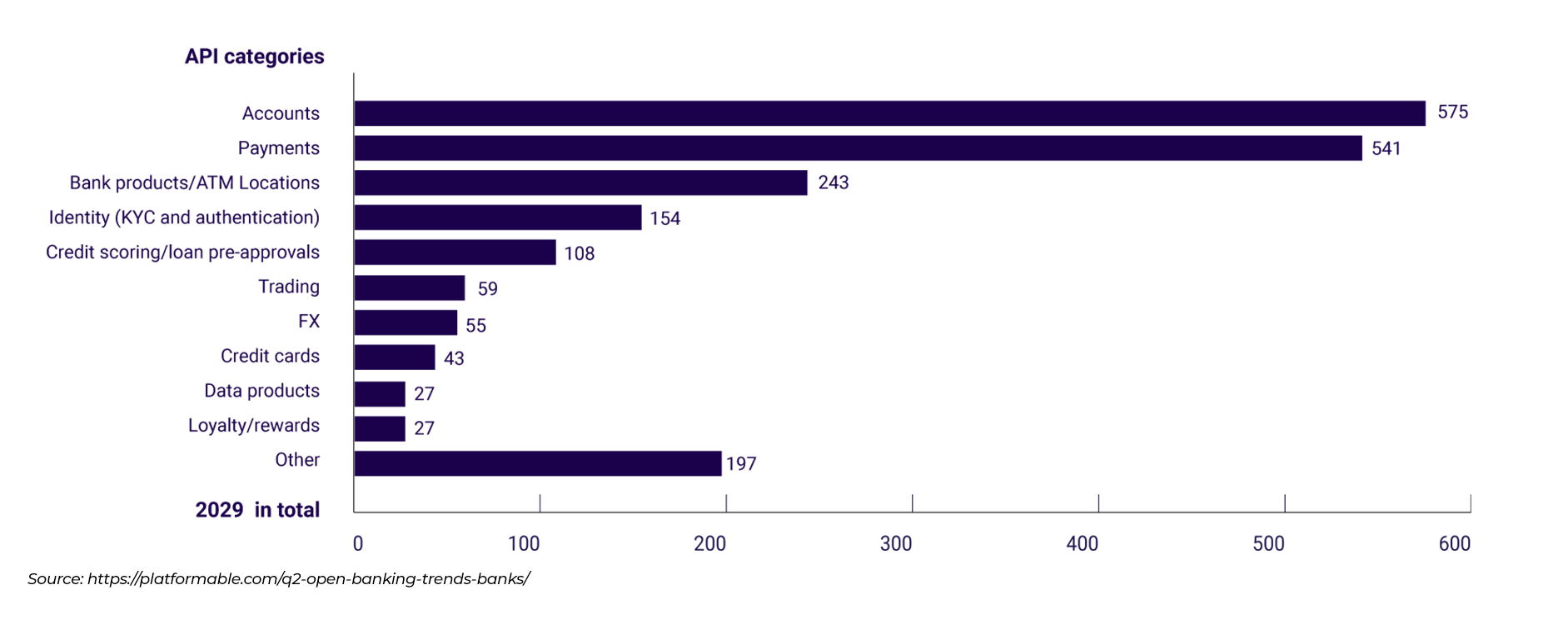

While the Open Banking was continuing to expand globally in line with the improvements in the digital world and regulatory landscape, the COVID-19 pandemic has accelerating the expansion even more as the dependency on the digital services has increased tremendously. According to a research conducted on the Open Banking trends in the second quarter of 2020, there is a rising tendency in opening APIs and moving towards platform models in all kinds of banks including commercial, agricultural, retail, and private ones.

The most preferred Open Banking API products are about the accounts and payments unsurprisingly. The interesting implication that can be deducted from the chart above is that the non-accounts are still not really popular among the API solutions and this indicates that the banks may neglect the potential of FinTech solutions and the future of financial products.

The regulatory compliance requirements and the workload may be seen as the hindering or decelerating force in banks’ move towards innovation; however, by incorporating open APIs and supporting their partners in building new products and services can actually help them acquire a leading position in the competitive financial landscape.

Benefits and opportunities for banks

Getting the support of APIs can actually provide banks with many direct and indirect advantages. One of them is the possibility to extending their value chain by reaching out particular consumer segments that they could not reach before. API partners which are experienced in that specific segment can offer trusted data for banks.

Another benefit is regarding the bank account opening. The FinTech companies offering crowdfunding and investing services have to require from their customers to have bank accounts. As a result, the banks working with these partners increase the number of their account creations excessively.

In addition to the pre-defined uses and benefits of APIs such as regulatory requirements and secure data sharing, banks can also utilize the APIs to improve their internal infrastructures for better digital delivery services. Especially after the acceleration of digitalization as a result of the global pandemic, the need to work with API teams in building a new digital banking infrastructure will be even more crucial. Based on the data achieved with studies, 25% of customers aged between 18 to 34 said that they will not prefer to visit physical bank branches even though the pandemic ends.

Another point related to the effects of the pandemic on the financial world is the customer loans. In many cases, laws forcing banks to allow their customers to freeze their loans because of COVID-19 which poses a risk for the business planning of banks. So, at this point, APIs can play an important part in helping banks address growing customer loan defaults. Banks by cooperating with FinTech partners are able to manage the risk by recalculating the credit risks, support customers in stretching cashflows, extend loan arrangements and find optional loan models to prevent loan defaults. Since the loan defaults are one of the most important key indicators in reports created for bank investors, finding a solution to this problem may help banks operate efficiently and maintain their customers and incomes during the economic crises like this.

Beyond the horizon

Open Banking encourage banks, via regulatory requirements or innovative benefits, with an aim to improve customer experience and financial services by opening key banking functions via APIs. This, eventually, will enable FinTechs or other stakeholders to offer more services and products to consumers. The advantage of banks in this new system is to improve their digital transformation, which is not just a necessity but more of an urgency and obligation in the era of digitalization, and to attract new customers while ensuring to keep their existing customers by forming partnerships with new services and products. Unfortunately, there are only small portion of banks that are aware of the advantages of this system and it is a fact that banks still need to improve their points of views and accept a platform mindset to benefit from the potentials. The banks that will be able to look beyond the horizon will probably be able to come into prominence in the future.

Murat Kurtulmuş, Implementation and Support Manager