Sibos 2020 Virtual Event – Highlights

This year’s hot topic and trend being digital as a result of the pandemic, for the first time, Sibos – the world’s premier financial services event – took place online, completely virtual. In these times of uncertainty, the discussions of the challenges and opportunities in the financial world has become more crucial. Under the light of the main theme of driving the evolution of smart finance, topics of collaboration, digitalization, optimization, sustainability and innovation in finance were included in the agenda of Sibos 2020.

Four main subject matters were discussed during the Sibos 2020. The first was understanding the customers of the future and ensuring better customer experience for frictionless payments with the help of digital solutions. The future of money and the question whether the digital currency will get real as a result of increasing digitalization were the second topic discussed. Another topic held in the digital event was about using technology in financial industry for good, mainly on improving privacy and transforming transaction monitoring. Finally, as one of the hot topics of the era, sustainability in finance which can be achieved via diversity and inclusive environments was highlighted.

1. Customer Experience at the core of frictionless payments

Understanding the customers of the future and ensuring smooth customer experience are one of the hot topics of the digital financing and Sibos 2020. In the process of overcoming the challenge of satisfying the needs of digital user, artificial Intelligence (AI) is being used extensively especially for the prevention of fraud to create better customer experience (CX) and for personalization of customer segments.

Cloud-based technologies such as distributed cloud computing are popular in the financial industry as they offer enhanced data security, better performance, redundancy in case of a disaster, all-inclusive compliance and finally better customer experience.

It is an undeniable fact that data is crucial for financial services to provide better customer satisfaction; however, it is also important to use that data properly and efficiently. Therefore, structured data is seen as the foundation of successful AI adoption because the way financial institutions structure data is at the same time enables them to use data for driving insights.

“Digital finance is developing rapidly, while concepts such as blockchain and bitcoin have entered at the very core of our lives; even by leading to question importance of cash money in global economy and trade, where consumers have no tolerance for a money transfer that takes up more than a day to complete.

Throughout SIBOS 2020, the focus was instant and frictionless payments as Javier Pérez-Tasso, CEO of SWIFT, mentioned in his opening speech. Ensuring that banks can access all flows in real time within the payment chain; it is obvious that it will lead to many constructive changes in terms of both compliance and settlement.”

-Serkan Arslan, CAMS, Head of Sales MENA

As the digital onboarding processes have gained more popularity with the digitalization, digital experience of the customers has become an important part of the client onboarding which is also closely related to the KYC (Know Your Customer) processes. As a result, digital customer experience and the digital compliance are now related to each other which might have been weird to say so a couple of years ago when digital processes were not used so commonly in the financial world. So, the goal of this era for the financial institutions is to create perfect digital compliance experiences. In achieving this goal, organizations need to focus on experience opportunities rather than the moments of compliance. For each opportunity, they need to establish trust, provide seamless experience, make use of the existing dark data, discover more about the user and demonstrate that they know them.

2. Will digital currency get real?

The future of money was discussed during Sibos 2020 mainly around the digital currencies and whether they will get real in the near future as digital privacy and digital identity are the issues that still need improvement. It is highlighted that since consumers are not actually the ones that are doing the transactions but the financial institutions are, FIs are supposed to provide the desired technology for the end consumers.

In most cases, consumers are looking at the products as the instruments that can help them actualize their needs and desires, so the product itself is not the need, it is just an instrument to satisfy a need. Therefore, for consumers, money is not the need but the instrument to reach a desire. They use money as a means of buying products and services they want. So, the question is “Why don’t we go fully digital with money then?”. Well, the issue of currency is a more complicated instrument, therefore, digitalization of money depends on different factors.

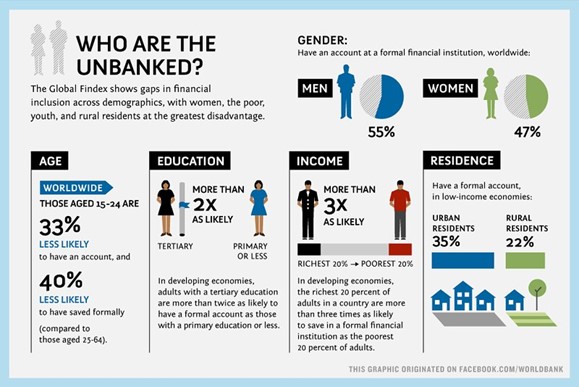

Going fully digital for the currency will require an access to the digitalized financial services by the whole society, including the unbanked who rely heavily on cash. Also, risks like false positives and false negatives may damage vulnerable populations more. So, they should be taken into consideration during this transition.

In terms of operational efficiency, digital currency is cheaper and faster. Private financial institutions, which are good at KYC and AML processes, can support central banks for the transition. As for the legal alterations, big international legal or regulatory changes may not be necessary at the beginning, just essential ones on a national level may suffice primarily. However, all the speakers in the discussion at Sibos 2020 agreed on the fact that digital currency cannot be a cure itself but more of an additional currency in the future. They also concluded that they anticipate less than 5% contribution from digital currencies to the cross-border payments in the midterm.

3. Technology for good

Getting the best of technology to improve the financial services was another topic discussed during Sibos 2020. Especially transforming digital monitoring with the help of privacy-enhanced technology (PET) was highlighted as the capabilities of the PET include but not limited to:

• Comprehensive data for checking market-wide information and make computations for the risks

• Sharing the results of the computations with regulated entities.

• Regular feedback and refinement on indicators guaranteed with validity testing through application to the market.

• Agile and intelligence-driven deployment of algorithms and indicators.

In order to achieve a technological revolution in the financial services and provide the best experiences and solutions in the digital era, cooperation of the stakeholders (banks and FinTechs), intersectionality, diversity and inclusion are needed.

Collaborations of banks and FinTechs may result in a more convenient financial services environment because they can compensate for the weak sides of each other. FinTechs are highly customer-oriented while they may remain weak on the product side. On the other side, banks may neglect customer side most of the time but they are highly product-oriented. Therefore, their partnership can form a really useful ally for the financial services industry.

“In order to improve customer transactions to be faster and simpler in the new financial landscape, payment platforms must also be open to innovation, compatible and more secure than ever. These changes will not only enhance customer experience of consumers but also corporate clients in the long term. For the innovations that are made or to be made in this context, all stakeholders need to cooperate with each other including banks, fintechs, auditors, regulators and technology companies; in that case technology and deep expertise can merge and bring the greatest benefit to the whole process.”

-Gökçe Gence, Head of Project and Solution

Improving and using technology for good are important however, this cannot be a strategy by itself. Technology presents instruments for building a good strategy but, it cannot provide the whole strategy for the development. The challenge for the banks in this case is not having or using the technology, but acquiring or keeping the customers.

4. Sustainable finance: Diversity & Inclusion

The concept of sustainability reflected itself on the world of banking as it does on many fields in the last decade. Banks are giving higher and higher importance to the issues that threaten our world such as poverty, climate change, gender equality and financial exclusion.

With the motto of “better banking, better lives”, the notion of responsible banking was discussed with highlights on the diversity, inclusion, equality and fairness. In avoiding unnecessary bias, financial institutions need to make sure that they achieve diversity in their tech teams. With responsible AI practicing, it is possible to reduce the unnecessary bias towards vulnerable people and achieve a more inclusive AI system. Microsoft Fairlearn is a toolkit for evaluating and enhancing fairness in AI powered systems to mitigate unfairness caused by cognitive biases related to gender, race, ethnicity, and so on . It aims to improve the overall fairness of the AI systems and to achieve a more diverse environment.

Inclusion is another topic that needs improvement within the financial world. So, the professionals seek advanced technologies to create a more inclusive, accessible and responsible banking. The biases cause exclusions which means a decrease of diversity. However, inclusive designs are expected to recognize exclusion and learn from diversity by putting people at the center. For the greater good of the people, empathy and emotional context are crucial. The inclusion eventually increases diversity which triggers innovation and also helps diminish the gender and racial pay gap in the society.

Conclusion

Bringing together – digitally this year – the experts in the financial industry from all over the world, Sibos 2020 included high quality discussion sessions on how the financial industry can make better and meaningful decisions to run smarter businesses while at the same time using and optimizing technology and data in a best way possible. The challenges discussed such as the financial exclusion resulting from conscious or unconscious bias or gender inequality are expected to lessen with the social evolution. The important concept within the frame of evolution is trust. Financial services industry should aim to create an inclusive and diverse environment that ensures trust for all people.