SWIFT Standard Changes 2019

SWIFT is a messaging format that allows banks, financial institutions to communicate by sending electronic messages. Every year, SWIFT collects the changes requested by its users, prepares and evaluates them with the technical and business consultants, and then publishes them in their SWIFT Standards Release Guide. This year, the document will be titled “SWIFT Standards MT (Message Type) November 2019 – Standards Release Guide” and become widely available in February via the SWIFT website.

The changes documented in the SWIFT Standards Release Guide are mandatory for all financial institutions. Since these changes will be active in the SWIFT Alliance from the second week of November every year, all participating bank systems needs to be aligned with these changes. Otherwise, the processing of messages will slow down due to incompatibility between the financial institutions and the SWIFT Alliance. This may result in loss of customer trust, as well as commercial loss for the financial institution in the future.

The annual MT Standards release ensures that message types (MTs) exchanged by SWIFT users remain suitable for the business areas in which they are used, as well as ensure compliance with changing regulations. Because the new standards are so widely implemented, it is important that the benefit of each change is balanced against the implementation cost.

Why are SWIFT Standards changes important?

The fact that SWIFT has established a very strong and secure financial messaging network all over the world shows us why financial Institutions prefer SWIFT over their other options.

The MTs provided and supported by SWIFT are used by global financial institutions.

SWIFT makes changes, considering the changing world and trade conditions, in standards and releases them in November every year. Every February, users (mainly financial institutions) are presented with a detailed document. These financial institutions are then expected to adapt their systematic infrastructure to the new changes every year. Once the amendments have been made, they can send and receive new or updated messages between the financial institutions and their own.

What can the financial institutions expect in “SWIFT MT November 2019 – Standards Release”?

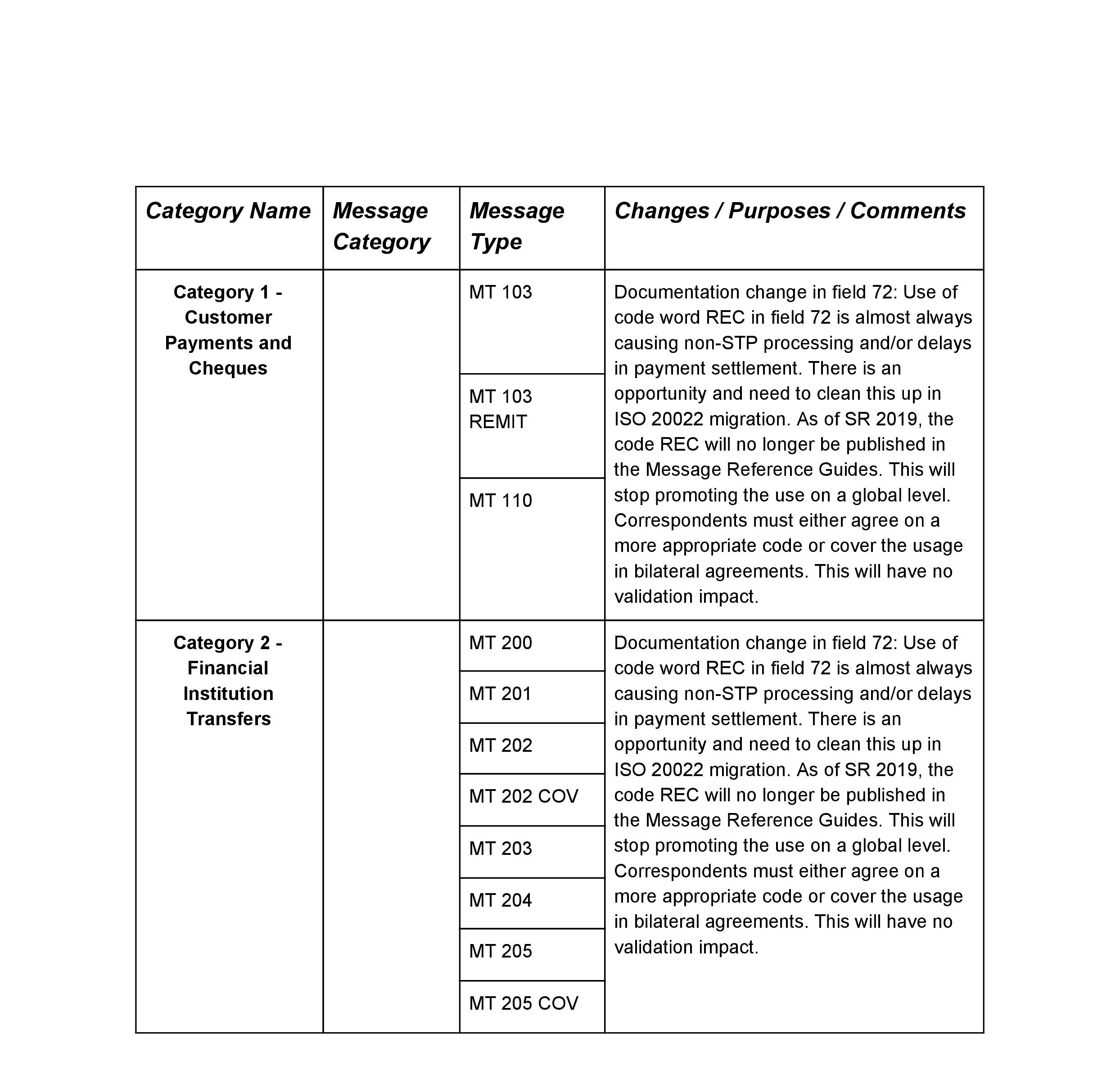

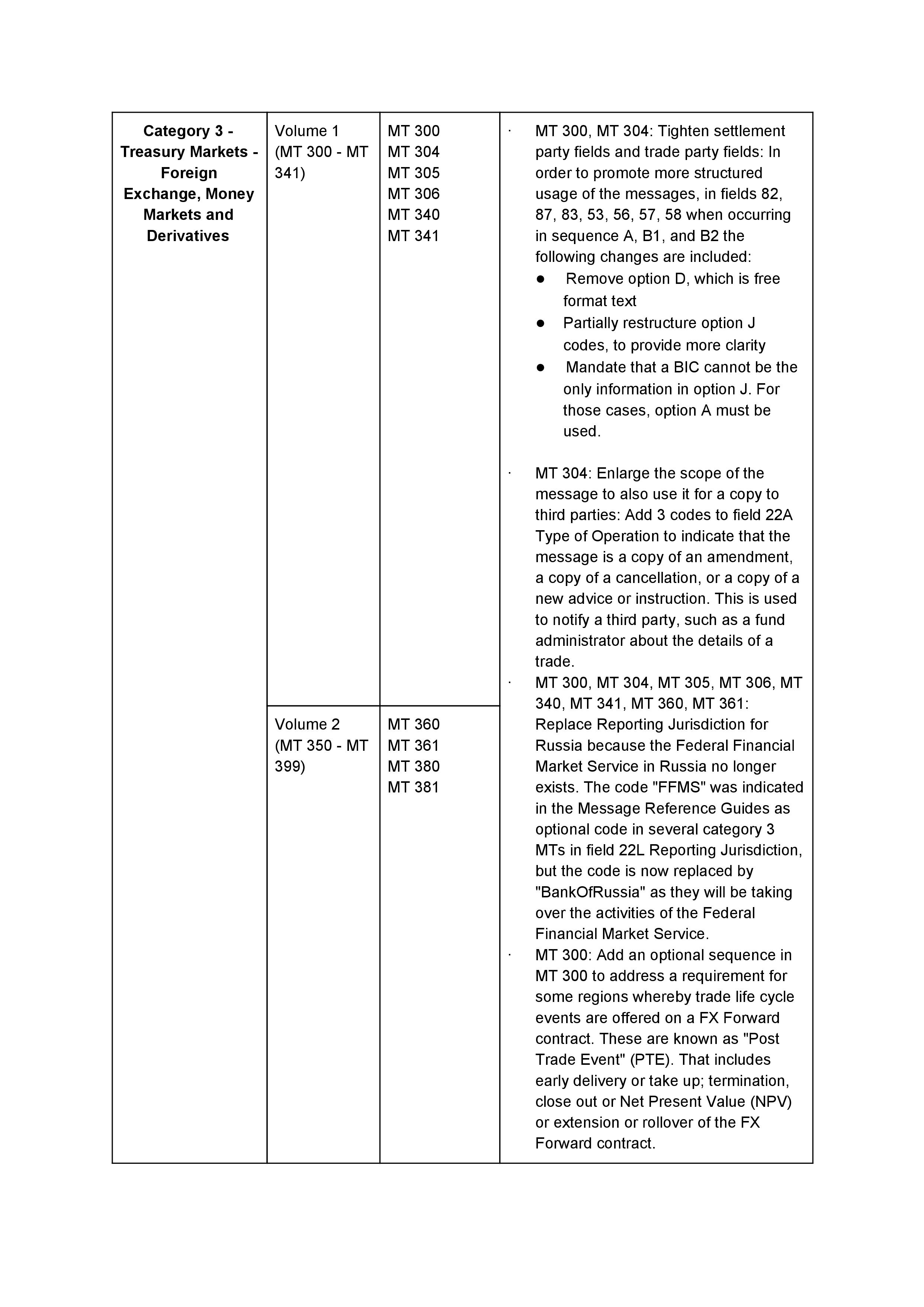

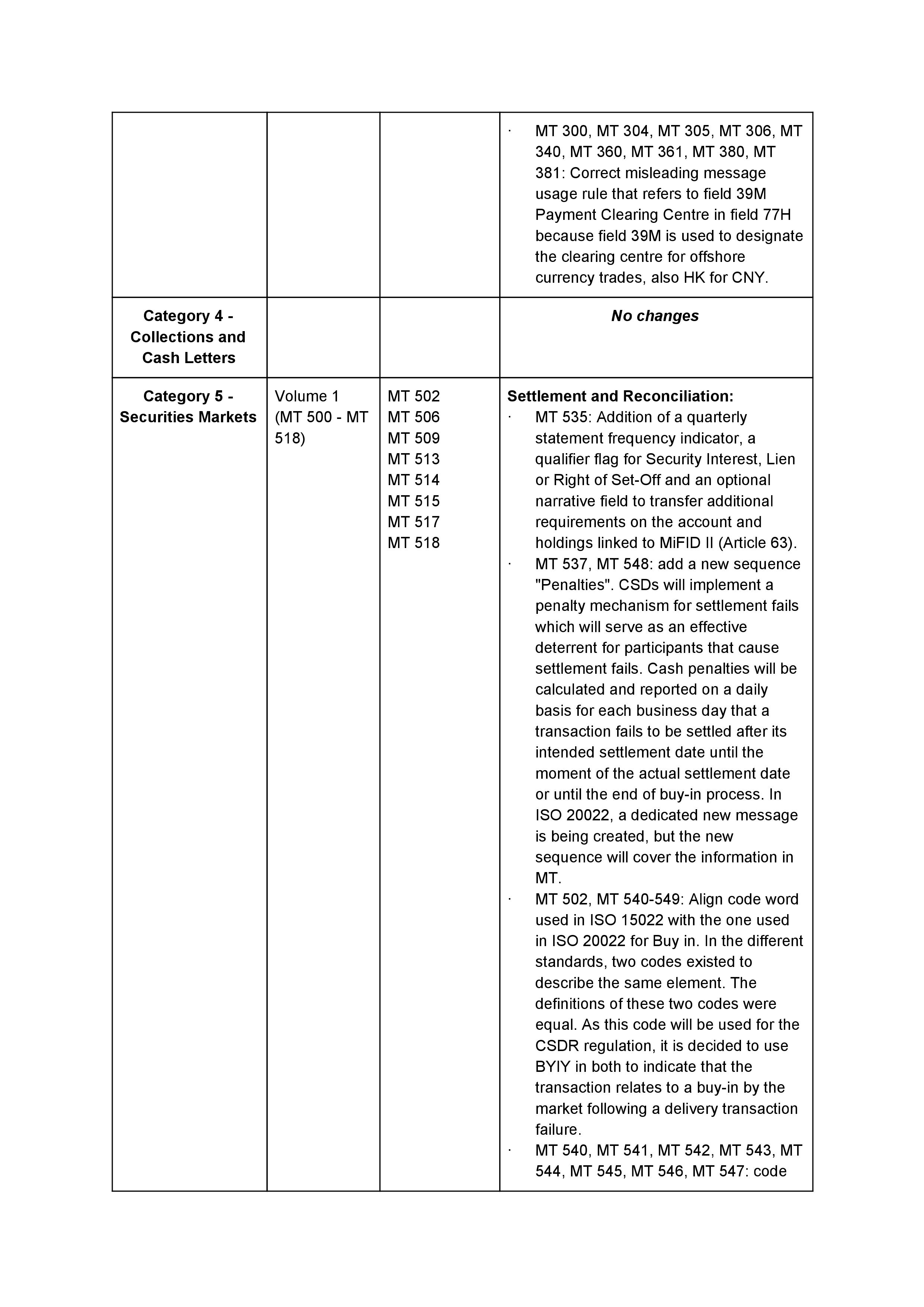

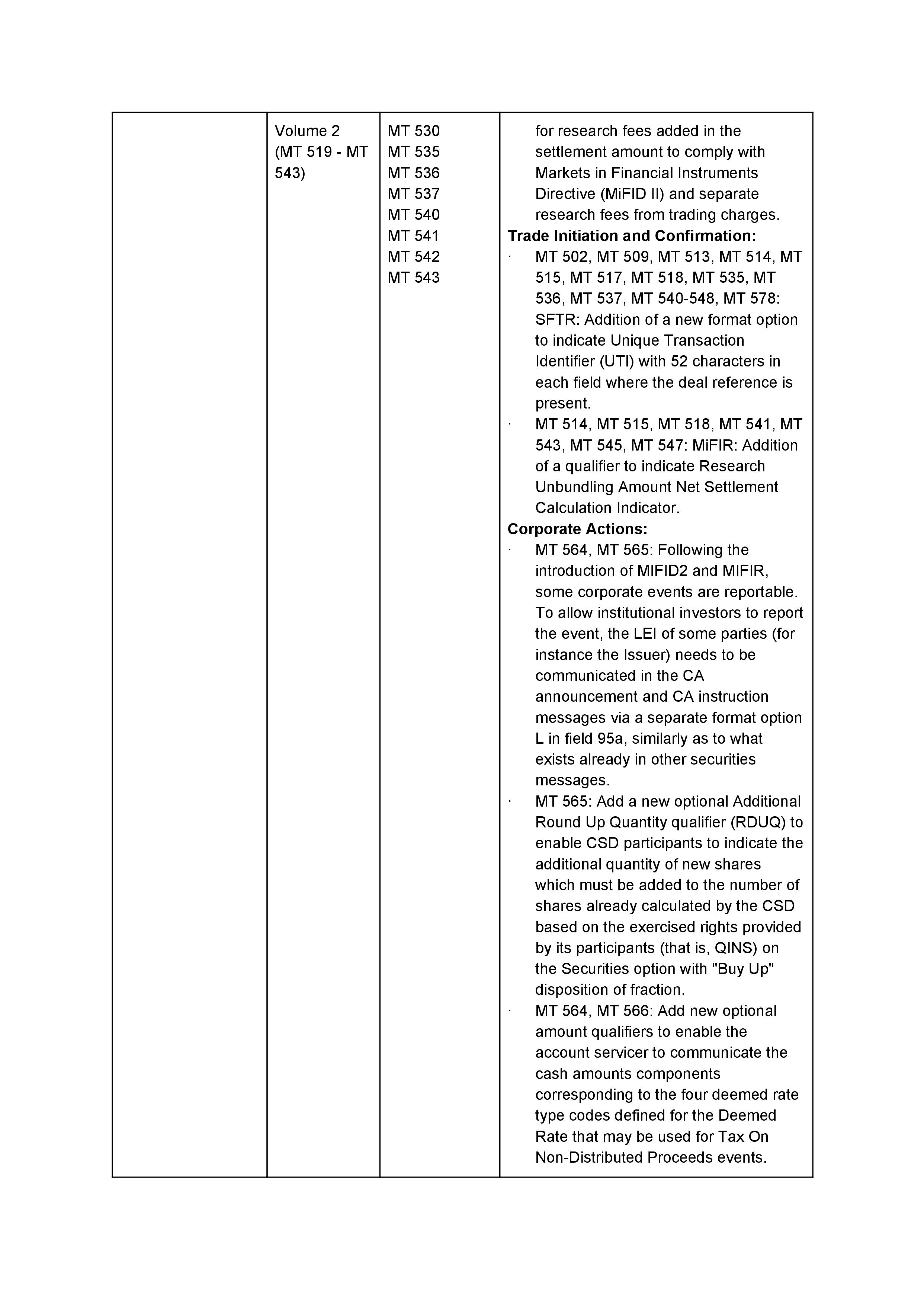

The changes are summarised below for easier understanding.

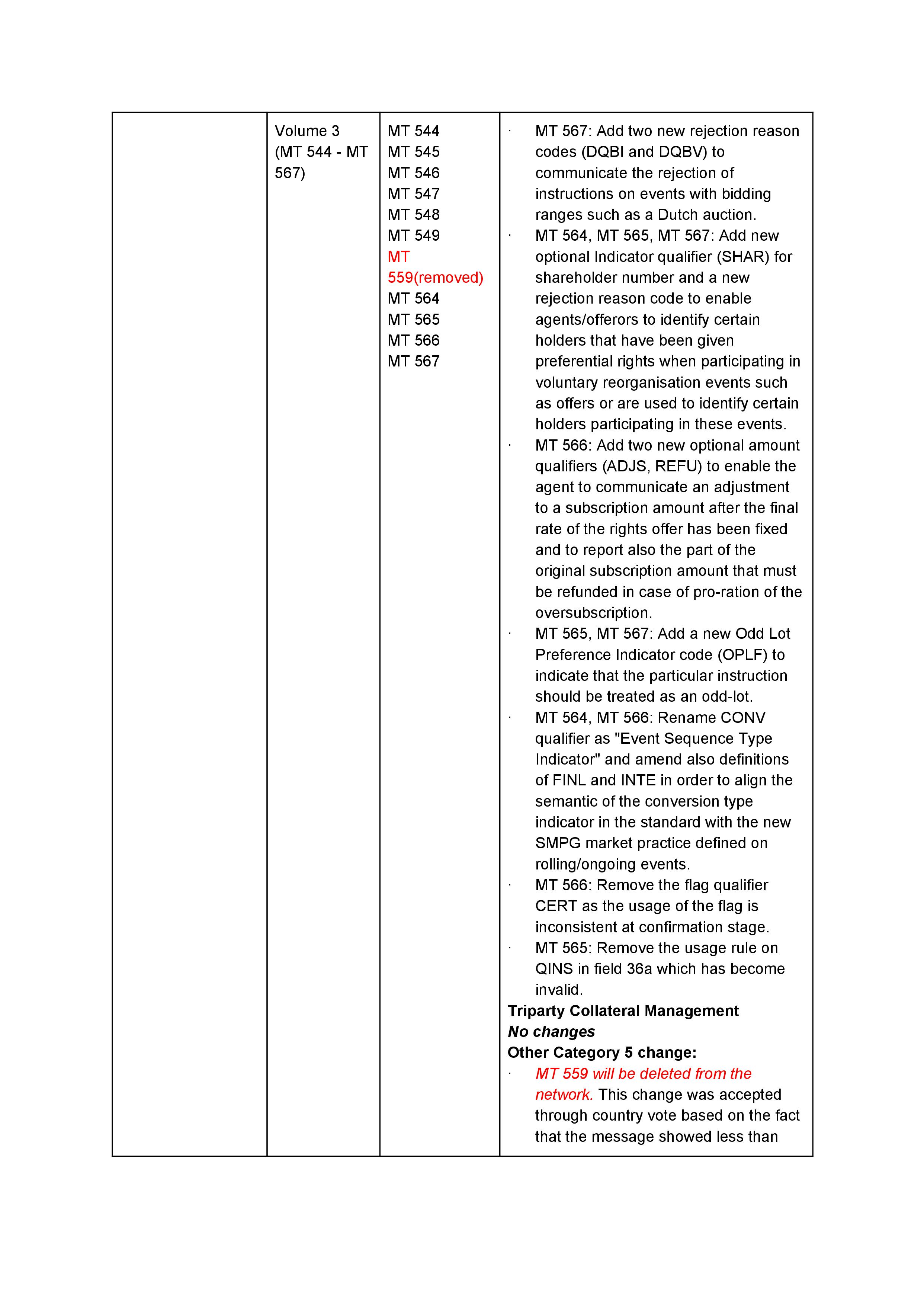

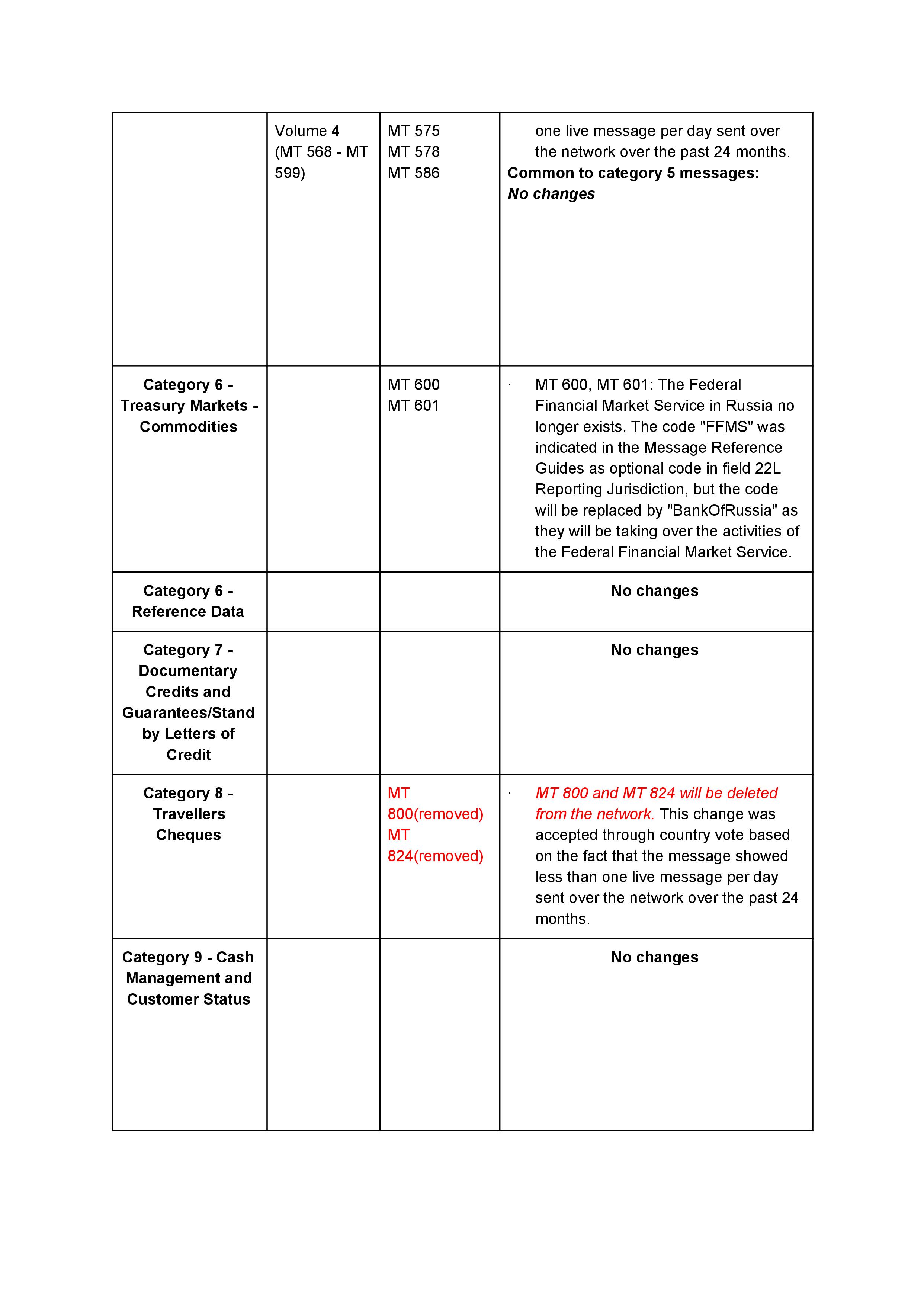

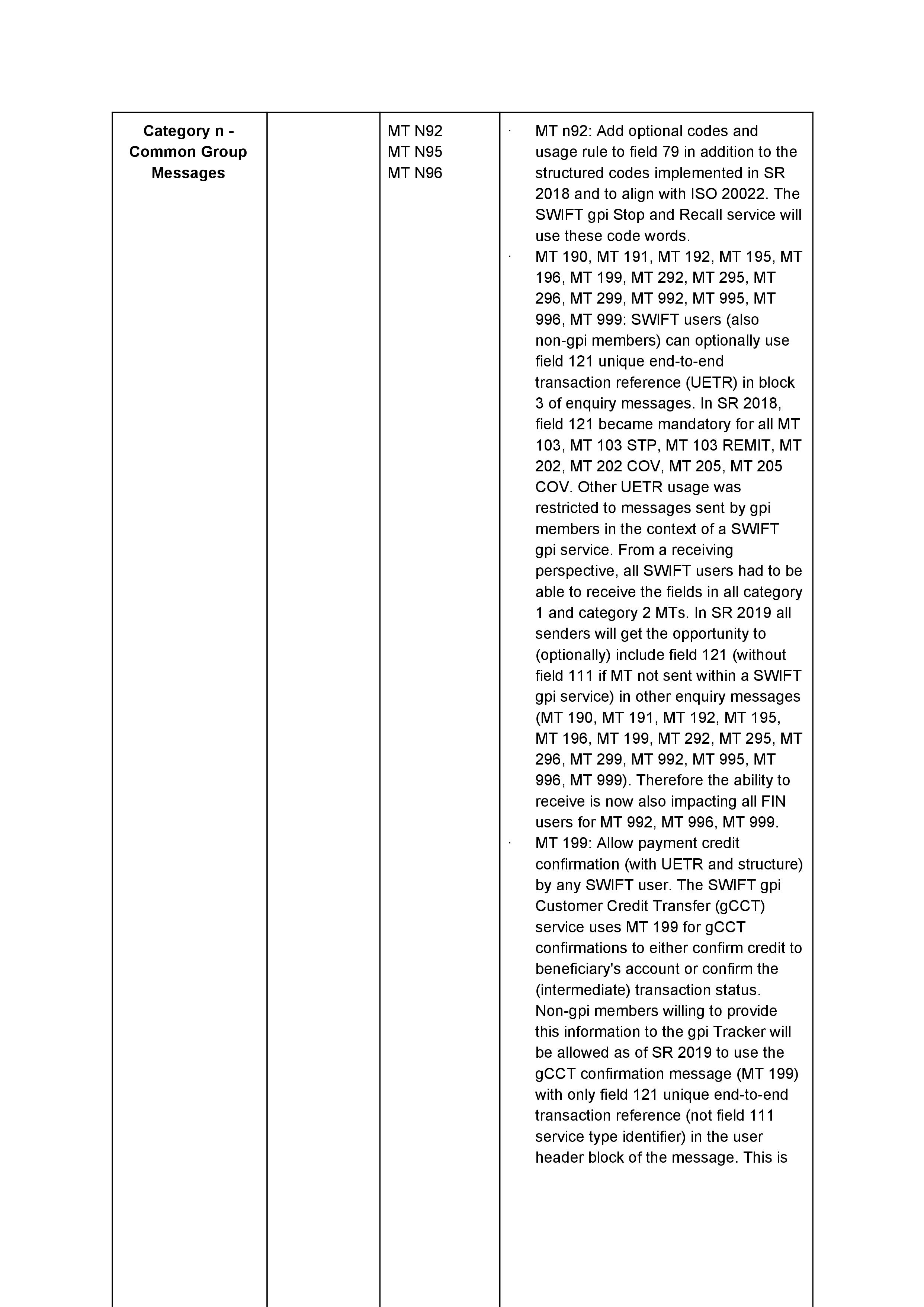

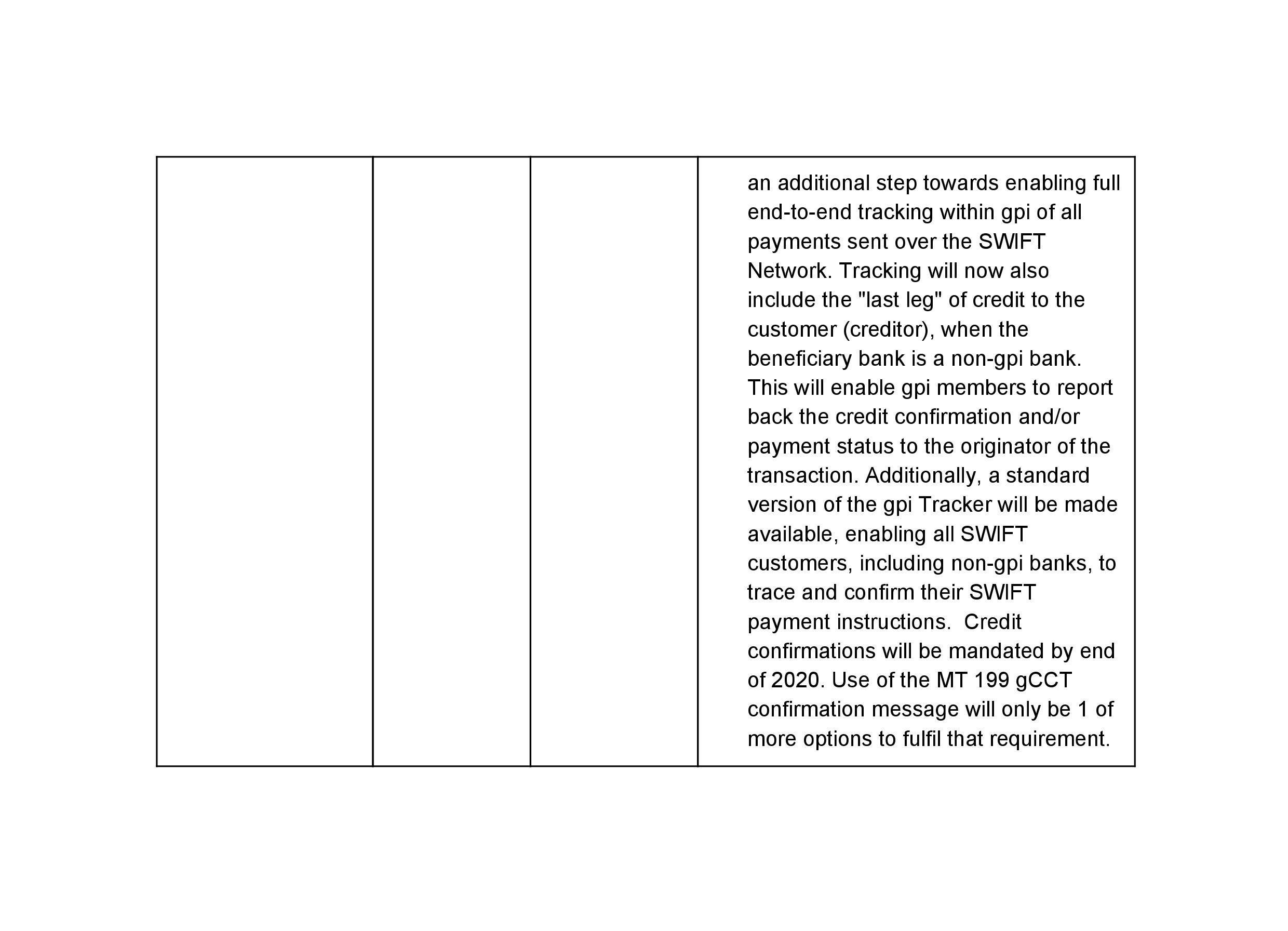

The Swift MT Standards changes will affect the following categories:

Customer Payments and Cheques

Financial Institution Transfers

Treasury Markets – Foreign Exchange, Money Markets and Derivatives

Securities Markets

Treasury Markets – Commodities

Travellers Cheques

Common Group Messages

Align your infrastructure with SWIFT Standard Changes before it’s too late!

Since these changes will be active at SWIFT Alliance in the second week of November every year, the bank system needs to be aligned with these changes.

Otherwise, the processing of messages will slow down due to incompatibility between the financial institutions and the Swift Alliance. This may result in loss of prestige, but also may cause a commercial loss for the financial institution, such as the transfer of further transactions to other financial institutions.

Nurdan Karakış, Business Consultant / Business Analyst