Updates on RTGS Renewal Programme

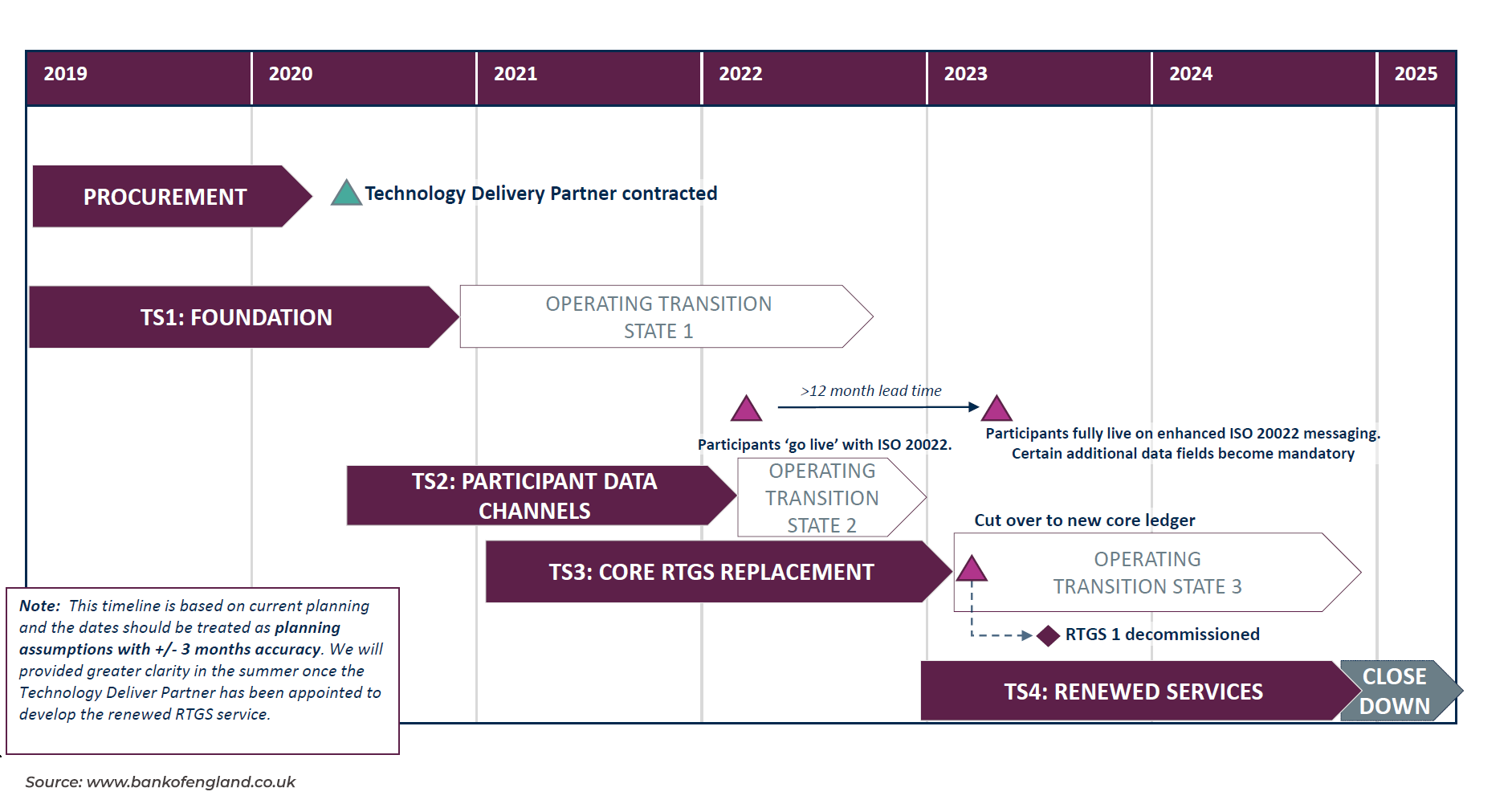

The Real-Time Gross Settlement (RTGS) service is defined as the infrastructure which holds accounts for the banks, building societies and other institutions by offering a final and risk-free settlement via real-time money transfers among these accounts. In the economy of the United Kingdom, this service has a crucial place because each day, approximately £685 billion worth of transactions are processed via RTGS. In May 2017, The Bank of England announced that they will renew the RTGS service and set out the Blueprint for RTGS Renewal. Together with the changing trends in payments, needs, technology and regulatory requirements, it was inevitable for the existing RTGS service to be renewed.

The need for the change

“The world has changed. In a changed environment, we have to make sure not just that the RTGS system works properly, but that we understand how all the players in the system fit together.”

William Lovell, head of future technology at the Bank of England.

The rivalry increasing with the challenger banks, the new non-bank institutions entering to the payments market and growing number of cyber attacks have driven the Bank of England to renew their RTGS system which was operating since 1996. They need to redress a balance between encouraging the competition and innovating the payment processes while also making sure that they sustain and improve if needed the current levels of resilience. As Lovell mentions, the change in the world unveils new challenges to be dealt with in order to ensure both monetary and financial stability by maintaining compliance with the policy goals as well. The financial stability can be achieved with a successful interconnectedness in the system; this refers to transactions and institutions at the same time. Therefore, the Bank of England puts the focus on increasing the simultaneity and interconnectedness of the links between separate transactions.

The improvements in the RTGS service

The new RTGS service aims to fully incapsulate and respond to the changing nature of the financial system by incorporating new capabilities for the settlements among the financial institutions.

There are five main points of focus in the vision of the RTGS renewal:

- Ensuring access to more companies

- Increasing resilience

- Offering wider interoperability

- Enhancing user functionality

- Strengthening end-to-end risk management

More specifically, the enhancements to be achieved in the new RTGS service can be summarized as:

- To guarantee the persistence of service, as well as the integrity of information and data within a broad array of different possibilities (i.e cyber attack), the flexibility and the protections, are improved.

- Contingency messaging arrangements are to be strengthened and the renewed RTGS service will become “channel-agnostic” meaning it will have the capacity to receive payment messages from different and multiple sources within normal operations.

- RTGS renewal will also cover the ability to support the innovative payment technologies of the future.

- Another enhancement is providing the necessary tools to empower the users to reroute their payments more flexibly when an outage emerges or to improve efficiency gains.

- The ISO 20022 messaging is introduced to the renewed RTGS service.

- The purpose is to improve the service to be technologically capable of operating almost 24 hours during business days and partially during the weekends.

Within the scope of RTGS renewal, the Bank of England is planning to adopt ISO 20022 messaging standards for the High Value Payments System (HVPS). By this developmental step, international harmonization and domestic interoperability are aimed to be achieved. The renewed RTGS will not just adopt ISO 20022, but it will make sure that ISO 20022 transcends the current message standard by initiating new information fields and also introducing structural improvements to the existing fields.

The updated RTGS service will also support the SWIFT GPI service to present CHAPS (Clearing House Automated Payment System) members with the traceability of payments. Since the SWIFT GPI is capable of supporting both domestic and international payments, the Bank of England will be able to make use of this system without a need to develop a new tracking & tracing function.

The Bank is also developing automated real-time functioning tools to provide access to the transactional and liquidity data of the RTGS system. They will incorporate business intelligence APIs such as write access APIs which will be responsible for securing the data sufficiently.

The renewed service can provide users with data on all aspects of the payment messages both in the final phase and on time. This feature is extremely helpful for users in terms of their own compliance monitoring. It will be possible to transfer the data to a potential future central utility functioning for monitoring. In the new RTGS system, it will not be possible to monitor transactions in advance.

Conclusion

The payments landscape has been facing drastic changes with the rise of digital and instant payments in the recent years. To catch up with the alterations happening in the financial ecosystem, the Bank of England activated the RTGS renewal program by taking initiative and seeking to improve its critical infrastructure which is a big phenomenon for the U.K. payments system. The overall goal of this renewal is to present the financial institutions with an access to a more up-to-date and secure payments platform that is suitable for the demands of the future.

Özgün KARS, Solution Advisor